Debit Cards

UzCard Virtual

Payment on the Internet for goods and services

Valid Thru : 5 years

Fee For Issue : For free

Card currency : UZS

HUMO Virtual

Online and contactless payment via smartphone with HUMOPay service

Valid Thru : 5 years

Fee For Issue : For free

Card currency : UZS

Mastercard Platinum FlyDubai

A New Level of Comfort, Bonuses and Exclusive Service

Valid Thru : 5 years

Fee For Issue : For free

Card currency : USD

Mastercard World Elite

Unlimited Opportunities around the World for the Most Demanding Customers

Valid Thru : 5 years

Fee For Issue : UZS 700 000

Card currency : USD / UZS

Minimum balance : $50/UZS 500 000

Visa Infinite

Premium Visa Infinite is the key to unlimited privileges and opportunitie

Valid Thru : 5 years

Fee For Issue : UZS 2 500 000

Card currency : USD / UZS

Minimum balance : $200/UZS 1 600 000

Visa Platinum - NBU / NJSC Co-brand card

Pay for purchases with card worldwide and receive 1 bonus mile

Valid Thru : 5 years

Fee For Issue : UZS 270 000

Card currency : USD / UZS

Visa Platinum

Special status and exclusive privileges

Valid Thru : 5 years

Fee For Issue : UZS 220 000

Card currency : USD / UZS

Visa Platinum - NBU / NJSC Co-brand card

Pay for purchases with card worldwide and receive 1 bonus mile

Valid Thru : 5 years

Fee For Issue : UZS 270 000

Card currency : USD / UZS

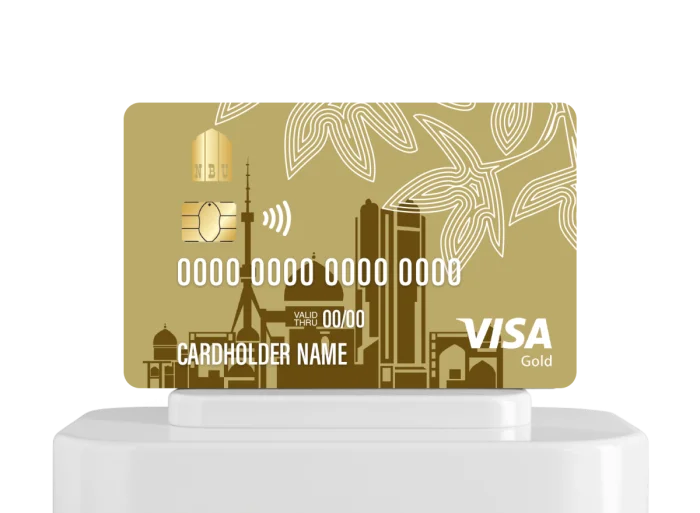

Visa Gold - NBU / NJSC Co-brand card

Pay for purchases with card worldwide and receive 1 bonus mile

Valid Thru : 5 years

Fee For Issue : UZS 170 000

Card currency : USD / UZS

Mastercard Platinum FlyDubai

A New Level of Comfort, Bonuses and Exclusive Service

Valid Thru : 5 years

Fee For Issue : For free

Card currency : USD

UzCard

Dual interface cards (both contact and contactless)

Valid Thru : 5 years

Fee For Issue : UZS 30 000

Card currency : UZS

UzCard Virtual

Payment on the Internet for goods and services

Valid Thru : 5 years

Fee For Issue : For free

Card currency : UZS

HUMO

Convenient payment method using contactless technology (NFC)

Valid Thru : 5 years

Fee For Issue : UZS 30 000

Card currency : UZS

Visa Infinite

Premium Visa Infinite is the key to unlimited privileges and opportunities

Valid Thru : 5 years

Fee For Issue : UZS 2 500 000

Card currency : USD / UZS

Minimum balance: $200/UZS 1 600 000

Visa Platinum - NBU / NJSC Co-brand card

Pay for purchases with card worldwide and receive 1 bonus mile

Valid Thru : 5 years

Fee For Issue : UZS 270 000

Card currency : USD / UZS

Visa Gold - NBU / NJSC Co-brand card

Pay for purchases with card worldwide and receive 1 bonus mile

Valid Thru : 5 years

Fee For Issue : UZS 170 000

Card currency : USD / UZS

Visa Platinum

Special status and exclusive privileges

Valid Thru : 5 years

Fee For Issue : UZS 220 000

Card currency : USD / UZS

Visa Gold

Gold privilege level worldwide

Valid Thru : 5 years

Fee For Issue : UZS 150 000

Card currency : USD / UZS

Visa Classic

The balance between the cost, quality and range of services

Valid Thru : 5 years

Fee For Issue : UZS 100 000

Card currency: USD / UZS

Visa Virtual

Secure online payments

Valid Thru : 5 years

Fee For Issue : UZS 10 000

Card currency : USD

Mastercard World Elite

Unlimited Opportunities around the World for the Most Demanding Customers

Valid Thru : 5 years

Fee For Issue : UZS 700 000

Card currency : USD / UZS

Minimum balance : $50/UZS 500 000

Mastercard Platinum FlyDubai

A New Level of Comfort, Bonuses and Exclusive Service

Valid Thru : 5 years

Fee For Issue : For free

Card currency : USD

Mastercard Platinum

A New Level of Comfort, Bonuses and Exclusive Service

Valid Thru : 5 years

Fee For Issue : UZS 220 000

Card currency : USD

Mastercard Gold

Financial Freedom around the World. Discounts and Special Offers

Valid Thru : 5 years

Fee For Issue : UZS 120 000

Card currency : USD / UZS

Mastercard Standard

A Convenient Tool for Paying for Goods and Services around the World

Valid Thru : 5 years

Fee For Issue : UZS 70 000

Card currency : USD / UZS

Mastercard Virtual

Secure online payments

Valid Thru : 5 years

Fee For Issue : UZS 10 000

Card currency : USD

Telegram-channel with pertinent information

Stay updated on the Bank’s activity