Markaziy bankining kengaytirilgan Boshqaruv majlisi bo'lib o'tdi

20.04.2016

3387

Markaziy bankining kengaytirilgan Boshqaruv majlisi bo'lib o'tdi

UzReport.uz

Respublika Markaziy bankida bank tizimining 2016-yil I-choragidagi faoliyati yakunlari hamda joriy yilning 15-yanvarida Vazirlar Mahkamasining majlisida mamlakatimiz Prezidenti I.A.Karimov tomonidan belgilab berilgan 2016-yilgi iqtisodiy dasturning eng muhim yo'nalishlari va ustuvor vazifalarining o'z vaqtida va to'liq hajmda ijro etilishini ta'minlashga bag'ishlangan kengaytirilgan Boshqaruv majlisi bo'lib o'tdi.

Qayd etildiki, hisobot davrida Markaziy bankning pul-kredit siyosati 2016-yilga mo'ljallangan makroiqtisodiy ko'rsatkichlarning bajarilishiga, davlatimiz rahbarining bank tizimini yanada isloh qilish, uning barqarorligini oshirish hamda yuqori xalqaro reyting ko'rsatkichlariga erishishga qaratilgan farmon va qarorlarida belgilangan vazifalarning so'zsiz bajarilishini ta'minlashga qaratildi.

Hisobot davrida mamlakatimiz bank tizimining kapitallashuv darajasini oshirish, uning likvidligini yanada mustahkamlash, barqarorligini kuchaytirish borasida keng qamrovli tizimli chora-tadbirlar amalga oshirildi.

Natijada, bank tizimida erishilgan ko'rsatkichlar nafaqat xalqaro umumqabul qilingan me'yorlarga mos keladi, balki ayrim yo'nalishlar bo'yicha undan ham yuqori ko'rsatkichlarga erishildi.

Xususan, bugungi kunda bank tizimi kapitalining etarlilik darajasi 23,2 foizni tashkil etib, u xalqaro bank nazorati bo'yicha Bazel qo'mitasi tomonidan 8 foiz qilib belgilangan talabga nisbatan qariyb 3 barobar ziyoddir. 2016-yilning 1-aprel holatiga ko'ra, banklarning umumiy kapitali 8 trln. so'mdan oshib ketdi.

Bank tizimining joriy likvidlik darajasi bir necha yildan buyon 64,5 foizdan yuqori bo'lib, bu ko'rsatkich ham jahon amaliyotida umumqabul qilingan minimal ko'rsatkichdan 2 barobardan ortiqdir.

Bank aktivlari 2015-yilning 1-aprel holatiga nisbatan 25,4 foiz o'sib, bugungi kunda 69,7 trln. so'mga yetdi.

Banklarning moliyaviy barqarorligini yanada mustahkamlash borasida amalga oshirilayotgan keng ko'lamli chora-tadbirlar ularningning kreditga layoqatlilik bo'yicha xalqaro reyting baholari olishiga o'zining ijobiy ta'sirini ko'rsatmoqda.

Xususan, Moody’s xalqaro reyting agentligi O'zbekiston bank tizimining rivojlanish istiqbollariga ketma-ket oltinchi yil «barqaror» reyting bahosini berdi.

Standard & Poor’s va Fitch Ratings reyting agentliklari ham O'zbekiston bank tizimi faoliyatini «barqaror» baholamoqda.

Bugungi kunga kelib, respublikamizda faoliyat ko'rsatayotgan 26 ta tijorat bankining barchasi nufuzli xalqaro reyting agentliklarining «barqaror» reyting baholariga egalar.

Bank tizimi faoliyatining asosiy indikatorlari, chunonchi, «banklarning umumiy kapitali etarliligi», «tijorat banklarining likvidligi», «depozitlar hajmining dinamikasi», «kredit qo'yilmalari hajmining o'zgarishi» 2016-yilning I-choragi yakunlari bo'yicha yuqori baholarga mos bo'ldi.

Banklar tomonidan 2016-yil uchun ustuvor vazifa qilib belgilangan sanoatda yuqori texnologiyali va zamonaviy bo'lgan eng muhim obyektlar hamda quvvatlarni ishga tushirish, ishlab chiqarishni texnik va tehnologik jihatdan yangilash va modernizatsiyalashga qaratilgan keng ko'lamli chora-tadbirlar amalga oshirilmoqda.

Xususan, hisobot davrida iqtisodiyotning real sektoriga yo'naltirilgan kreditlarning umumiy hajmi 2015-yilning 1-aprel holatiga nisbatan 26,7 foiz ko'payib, shu yilning 1-aprel holatiga ko'ra, 44,1 trln. so'mni tashkil etdi.

Investitsion kreditlar miqdori ham o'tgan yilning shu davriga nisbatan 1,2 barobar oshib, 2016-yilning 1-aprel holatiga ko'ra, 2,7 trln. so'mni tashkil qildi.

Respublikamiz rahbarining kichik biznesni rivojlantirish uchun qulay ishbilarmonlik muhitini shakllantirish va tadbirkorlikka yanada keng erkinlik berish borasida qabul qilingan farmon va qarorlari ijrosini ta'minlash doirasida amalga oshirilgan keng ko'lamli chora-tadbirlar natijasida soha subyektlariga ajratilgan kreditlar hajmi 2015-yilning shu davriga nisbatan 1,3 barobar ko'payib, 2016-yilning 1-aprel holatiga ko'ra, 3,6 trln. so'mni tashkil etdi. Jumladan, mikrokreditlar hajmi 772,9 mlrd. so'mdan oshib, bu ko'rsatkich ham o'tgan yilning shu davriga nisbatan 1,3 barobar o'sdi.

Tijorat banklari tomonidan ayollarning tadbirkorlik faoliyatini qo'llab-quvvatlashga yo'naltirilgan kreditlar miqdori 2015-yilning shu davriga nisbatan 1,3 barobar oshib, joriy yilning 1-aprel holatiga ko'ra, 409,7 mlrd. so'mdan oshib ketdi.

Shuningdek, banklar tomonidan yoshlarni, ayniqsa kasb-hunar kollejlari bitiruvchilarini tadbirkorlik faoliyatiga keng jalb qilish, ularning biznes loyihalarini moliyaviy qo'llab-quvvatlashga ham jiddiy e'tibor berib kelinmoqda.

Xususan, hisobot davrida mazkur yo'nalishga 63,4 mlrd. so'm miqdorida kreditlar ajratilib, mazkur ko'rsatkich ham 2015-yilning shu davriga nisbatan 1,3 barobardan ziyodga oshdi.

Ta'kidlash joizki, mamlakatimizda bank tizimini isloh qilish va erkinlashtirish borasida erishilgan yutuqlar Jahon banki va Xalqaro moliya korporatsiyasining tadbirkorlik faoliyatini yuritish shart-sharoitlari bo'yicha «Doing Businees-2016» navbatdagi yillik hisobotida yana bir bor o'z tasdig'ini topdi.

2015-yilning oktyabr oyida chop etilgan hisobotga ko'ra kreditlash shartlari bo'yicha so'nggi uch yilda mamlakatimiz reytingi 113 pog'ona, ya'ni 154-o'rindan 42-o'ringa ko'tarildi.

Xususan, ushbu ko'rsatkich bo'yicha ko'tarilish 2013-yilda 24 pog'ona, 2014 yilda 26 pog'ona va 2015-yil yakuni bo'yicha 63 pog'onani tashkil etdi.

Shuningdek, «Kredit axboroti almashinuvi indeksi» bo'yicha O'zbekiston bank tizimi mavjud 8 balli tizimda 7 ballga baholandi va bu ko'rsatkich Iqtisodiy hamkorlik va rivojlanish tashkiloti (OSED)ga a'zo ba'zi davlatlar o'rtacha ko'rsatkichidan yuqoridir.

Mamlakatimiz banklarining barqaror holati, bank tizimiga bo'lgan ishonchning yildan-yilga oshishi hamda aholi real daromadlarining o'sib borishi aholi va xo'jalik yurituvchi sub'ektlarining bo'sh pul mablag'larini omonatlarga jalb qilishning mustahkam asosi bo'lib xizmat qilmoqda.

Tijorat banklarining resurs bazasini ko'paytirish borasida amalga oshirilayotgan ishlar natijasida banklarning jami depozitlari miqdori yildan yilga oshib bormoqda. Xususan, ushbu ko'rsatkich 2015-yilning shu davriga nisbatan 27,6 foiz o'sib, 2016-yilning 1-aprel holatiga ko'ra, 36,8 trln. so'mni tashkil etdi.

Hisobot yilida moliyaviy xizmatlar tarkibida, bevosita bank xizmatlarining ulushi 89,6 foizga etib, bu ko'rsatkich ham o'tgan yilning shu davriga nisbatan 1,2 barobar oshdi. Bu esa, aholi hamda tadbirkorlik sub'ektlariga zamonaviy bank xizmatlari ko'rsatish sifati va ko'lamini kengaytirish borasida ko'rilayotgan maqsadli chora-tadbirlarning samarasidir.

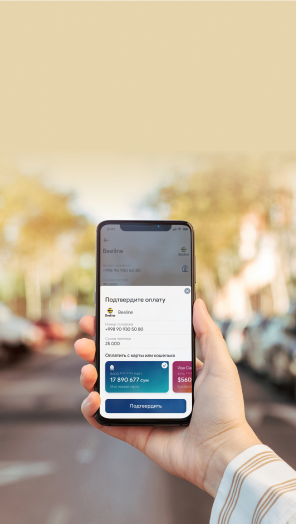

Respublikamizda naqd pulsiz hisob-kitoblar tizimini yanada rivojlantirishga ham alohida e'tibor berilmoqda. Muomalaga chiqarilgan plastik kartochkalar soni mutassil ortib, ularning umumiy soni bugungi kunga kelib 17,1 mln. donadan oshib, savdo va xizmat ko'rsatish shoxobchalariga o'rnatilgan hisob-kitob terminallarining soni esa 190,8 mingtaga yetdi.

UzReport.uz