IPO

The National Bank of the Republic of Uzbekistan for Foreign Economic Activity, in accordance with the Resolution of the Cabinet of Ministers of the Republic of Uzbekistan No. 268 dated May 10, 2017 and the Underwriting Agreement, begins a subscription campaign for shares of QUARTZ JSC and invites everyone to become a shareholder of one of the leading industrial enterprises of Uzbekistan.

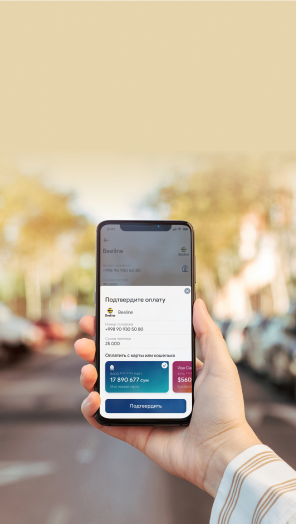

4,574,934 shares of QUARTZ JSC are on sale now. The shares are sold through an initial public offering (IPO) on the Tashkent stock exchange. Buyers offer their prices of shares in their applications and the shares will be sold at the best offered prices. Applications should specify the price from 3,000 to 9,100 UZS per share. The buyer shall make 100% prepayment for the shares when submits the application. One person can apply for 2,287 shares maximum.

Subscription start date is December 05, 2017, subscription end date is April 3, 2018. If the application is rejected, the buyer's funds shall be returned within 15 days from the date of registration of the transaction.

You can get more detailed information from the investment intermediary underwriter DALAL STANDARD LLC (Broker) and on the websites www.dalal.uz, www.kvarts.uz и www.nbu.uz.

Phones: +998901875125; +998712367655.

Helpline: +998712320738.

About Quartz JSC

Since December 5, 2017, more than 4.5 million shares of Quartz Joint Stock Company have been put up for open sale.

The shares are sold through an initial public offering (IPO) technology at the best offered purchase price.

In accordance with the Resolution of the Cabinet of Ministers No. 268 on the Organization of the Public Offering of Shares on the Stock Exchange dated May 10, 2017, the National Bank for Foreign Activities is the IPO organizer-underwriter of QUARTZ JSC's shares.

QUARTZ JSC and the National Bank concluded the agreement on September 15, 2017 which provides that the Bank undertakes to guarantee the sale of 100% issued shares. However, one person can not buy more than 0.05% of the total number of QUARTZ JSC's shares placed through IPO.

Applications of individuals and legal entities shall be accepted by investment intermediaries (brokers) with a price from 3,000 UZS to 9,100 UZS per share. Information about investment intermediaries is available on the websites of Securities Market Coordination and Development Center and "Tashkent" Republican Stock Exchange.

Subscription expiration date is April 3, 2018

The Initial Public Offering, briefly IPO, means the initial public sale of shares of a joint-stock company to an unlimited number of persons. Shares are sold by placing additional shares through an open subscription.

QUARTZ JSC was established in 1975, is the largest enterprise producing a flat glass, glass for the automotive industry glass jars, bottles and refractory materials.

QUARTZ JSC is the only manufacturer of construction glass and meets more than 60% of the demands for these products in the Republic of Uzbekistan. The market share of the enterprise for glass is more than 95%, and for glass bottles is up to 50%.

It is obvious that the shares should be attractive to both investors and shareholders of the company. The financial position of QUARTZ JSC is stable and the enterprise has a high dynamics of revenue and profit growth. For the period from 2014 to 2016, net sales revenue increased by 1.5 times, and net profit by 2.2 times.

Over the past 3 years, 46-50% of net profit has been steadily distributed to the payment of dividends. QUARTZ JSC in 2016 received a net profit of 56.18 billion UZS, and 28.09 billion UZS were the dividends. At the same time, the dividend amount per share was 1,172.3 UZS or 68.36 percent of the share nominal value, which makes the shares very marketable.

2017 was a successful year for the company. The forecasted net profit for this year is over 80 billion UZS, which is 1.5 times more than the profit of the last year.

The main project in the Development Strategy of Joint-Stock Company for 2017-2021 is the construction of a new line for manufacturing the flat glass with a capacity of 400 tons per day (China, Europe). The project will expand the range of glass, increase its thickness, raise production to 20.0 million m2 per year, increase export sales and reduce energy costs for production.

The market advantage of QUARTZ JSC is that it constantly expands the range of products in demand on the market and meets international standards. In 2017, the company mastered a new type of product — art window products on a hardened glass with a color pattern on the glass used for facade design, furniture made of glass, mirrors, doors and household appliances.

QUARTZ JSC pays great attention to the product quality management system, which determines the further development of the company. The company has received international certificates of quality management system ISO 50001-2011, ISO 9001:2015 and other quality certificates.

In February 2017, QUARTZ JSC was awarded the International Star for Leadership in Quality (ISLQ) Prize in the category "Gold" in the field of Leadership, Quality and Innovation, and the ceremony took place during the BID World Quality Commitment Convention in Paris.

Also, the company received international awards at the events held in 2017 in Moscow: in August, it was awarded the "International Quality Standard" award, and in December, it was awarded the "Reliable Partner" International Award with an Honorary Prize and a Diploma of the Laureate for its professional activity, development and strengthening of international cooperation.

You can get more detailed information on QUARTZ JSC by phone 03733724403, +998973375430 and +998901875125 (phone number of broker Dalal Standard LLC, on the websites of QUARTZ JSC, "Tashkent" RSE, the National Bank and the Broker Dalal Standard LLC.

Our Telegram channel: QUARTZ JSC.